Damage Assessment –Automated Platform for Insurance Operations

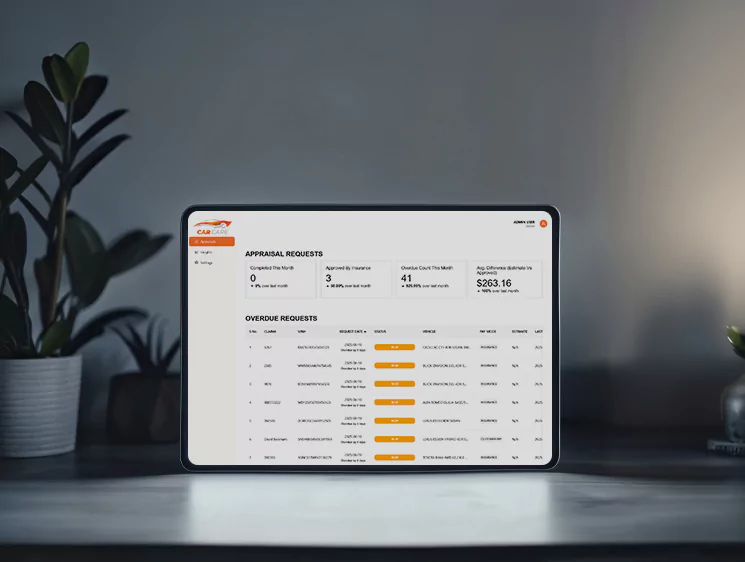

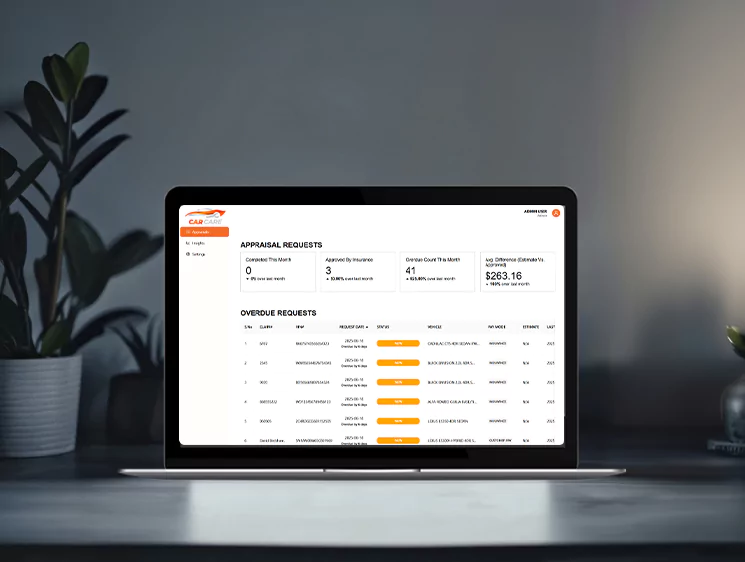

Developed a web-based platform to automate vehicle damage assessment and improve communication between car repair shops and insurance companies.

Industry:

Insurance / Automotive Services

Solution Type:

Damage Assessment Automation Platform (Web Application)

Technologies:

MERN Stack (MongoDB, Express.js, React.js, Node.js)

Architecture:

Modular, scalable, service-based

Executive Summary

Digital Dividend partnered with an insurance-focused client to build a Damage Assessment Automation Platform.

The goal was to replace slow, manual damage reporting with a digital system that connects car repair shops and insurance companies in one place.

The platform reduced delays, improved communication, and made damage approval faster and more transparent.

The Challenge

Before this platform, the process had many problems:

- Damage reports were handled manually

- Repair shops and insurers worked separately

- Approvals took too much time

- Information was incomplete or repeated

- No clear tracking of request status

- High chance of errors and disputes

- Poor visibility for managers and insurers

All this caused delays, confusion, and customer dissatisfaction.

Technology Stack

- Frontend: Modern web interface (responsive design)

- Backend: MERN Stack (MongoDB, Express, React, Node.js)

- Database: Structured data storage for accuracy

- Architecture: Scalable and secure

- Deployment: Cloud-ready

SOLUTION IMPLEMENTATION

The platform helped the client to:

- Reduce approval time

- Improve communication between insurers and workshops

- Eliminate paperwork

- Increase process transparency

- Track performance in real time

- Improve customer trust

The result was a faster, cleaner, and more reliable damage assessment process.